The 7-Minute Rule for Clark Wealth Partners

Wiki Article

Clark Wealth Partners Fundamentals Explained

Table of ContentsClark Wealth Partners Can Be Fun For EveryoneClark Wealth Partners for BeginnersClark Wealth Partners Things To Know Before You Get ThisAn Unbiased View of Clark Wealth PartnersThe Of Clark Wealth PartnersLittle Known Questions About Clark Wealth Partners.The Definitive Guide for Clark Wealth PartnersClark Wealth Partners Things To Know Before You Buy

Common factors to consider an economic expert are: If your monetary scenario has ended up being more intricate, or you do not have self-confidence in your money-managing skills. Conserving or browsing major life events like marital relationship, divorce, kids, inheritance, or job adjustment that might dramatically influence your monetary scenario. Browsing the change from saving for retired life to preserving wealth during retirement and just how to create a strong retired life revenue strategy.New technology has brought about more thorough automated financial devices, like robo-advisors. It depends on you to examine and identify the best fit - https://anotepad.com/notes/4mg4qd77. Inevitably, a good economic consultant ought to be as mindful of your financial investments as they are with their own, avoiding extreme charges, conserving money on tax obligations, and being as transparent as feasible about your gains and losses

The Only Guide for Clark Wealth Partners

Making a commission on item recommendations does not always indicate your fee-based expert works against your finest passions. They might be much more inclined to advise products and services on which they earn a commission, which may or may not be in your finest rate of interest. A fiduciary is legitimately bound to place their client's interests initially.This standard allows them to make recommendations for investments and solutions as long as they fit their customer's objectives, danger tolerance, and monetary circumstance. On the other hand, fiduciary experts are lawfully bound to act in their client's best rate of interest rather than their very own.

The Single Strategy To Use For Clark Wealth Partners

ExperienceTessa reported on all things investing deep-diving into intricate financial topics, losing light on lesser-known financial investment avenues, and revealing ways viewers can work the system to their advantage. As a personal finance professional in her 20s, Tessa is acutely familiar with the effects time and unpredictability have on your investment choices.

It was a targeted promotion, and it worked. Learn more Review less.

Clark Wealth Partners Things To Know Before You Buy

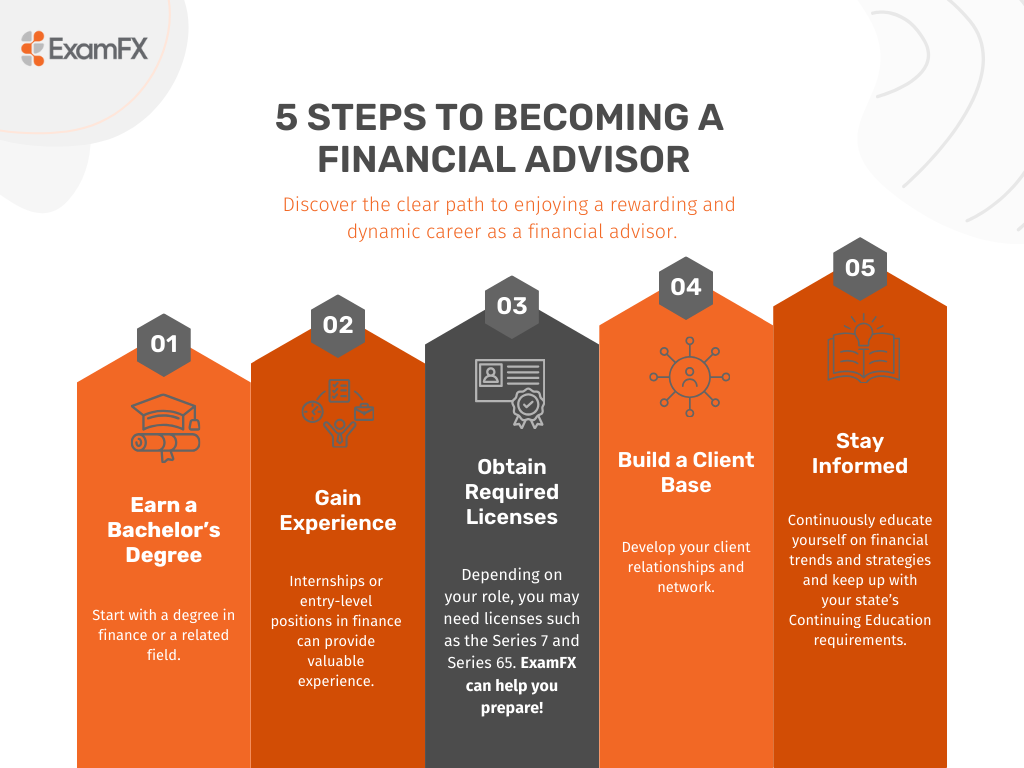

There's no single course to ending up being one, with some individuals starting in financial or insurance, while others start in audit. A four-year degree provides a strong foundation for careers in financial investments, budgeting, and customer services.

Getting The Clark Wealth Partners To Work

Common examples consist of the FINRA Collection 7 and Series 65 tests for securities, or a state-issued insurance policy permit for marketing life or medical insurance. While qualifications may not be legitimately required for all intending roles, companies and clients commonly watch them as a standard of expertise. We look at optional credentials in the next section.A lot of economic coordinators have 1-3 years of experience and experience with financial products, conformity standards, and direct customer interaction. A strong academic history is crucial, yet experience shows the capability to apply concept in real-world settings. Some programs incorporate both, permitting you to finish coursework while gaining monitored hours through internships and practicums.

Clark Wealth Partners Can Be Fun For Everyone

Several enter the area after functioning in financial, bookkeeping, or insurance coverage, and the change needs perseverance, networking, and often sophisticated credentials. Early years can bring long hours, stress to develop a client base, and the need to consistently confirm your knowledge. Still, the career offers solid long-lasting potential. Financial organizers take pleasure in the opportunity to function closely with clients, guide crucial life choices, and commonly accomplish versatility in schedules or self-employment.

Wide range supervisors can enhance their earnings with compensations, possession costs, and performance incentives. Economic managers oversee a team of monetary coordinators and advisors, establishing departmental method, taking care of conformity, budgeting, and routing interior operations. They spent less time on the client-facing side of the industry. Nearly all financial supervisors hold a bachelor's level, and many have an MBA or similar graduate level.

5 Simple Techniques For Clark Wealth Partners

Optional certifications, such as the CFP, generally call for extra coursework and screening, which can prolong the timeline by a number of years. According to the Bureau of Labor Data, personal economic advisors gain a median yearly yearly wage of $102,140, with top income earners making over $239,000.In other provinces, there are laws that require them to meet particular requirements to utilize the economic advisor or economic coordinator titles (financial planner in ofallon illinois). What sets some economic experts aside from others are education, training, experience and qualifications. There are many classifications for monetary consultants. For economic planners, there are 3 usual classifications: Certified, Personal and Registered Financial Organizer.

The Facts About Clark Wealth Partners Uncovered

Where to find a financial consultant will certainly depend on the type of recommendations you need. These establishments have staff who might help you recognize and acquire particular types of financial investments.Report this wiki page